nj ev tax credit 2022

TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its Charge Up New Jersey electric vehicle EV incentive program today taking one more step toward the Murphy Administrations goal of getting 330000 EVs on the road by 2025. New Jersey was offering money back but that program expired.

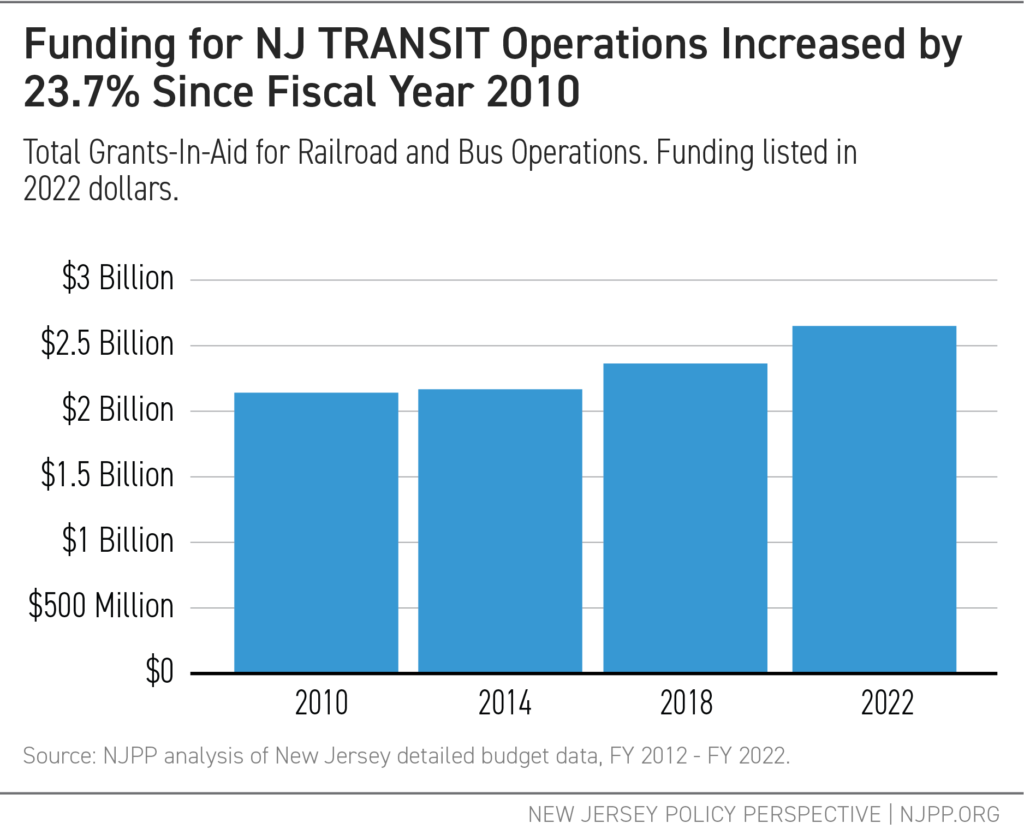

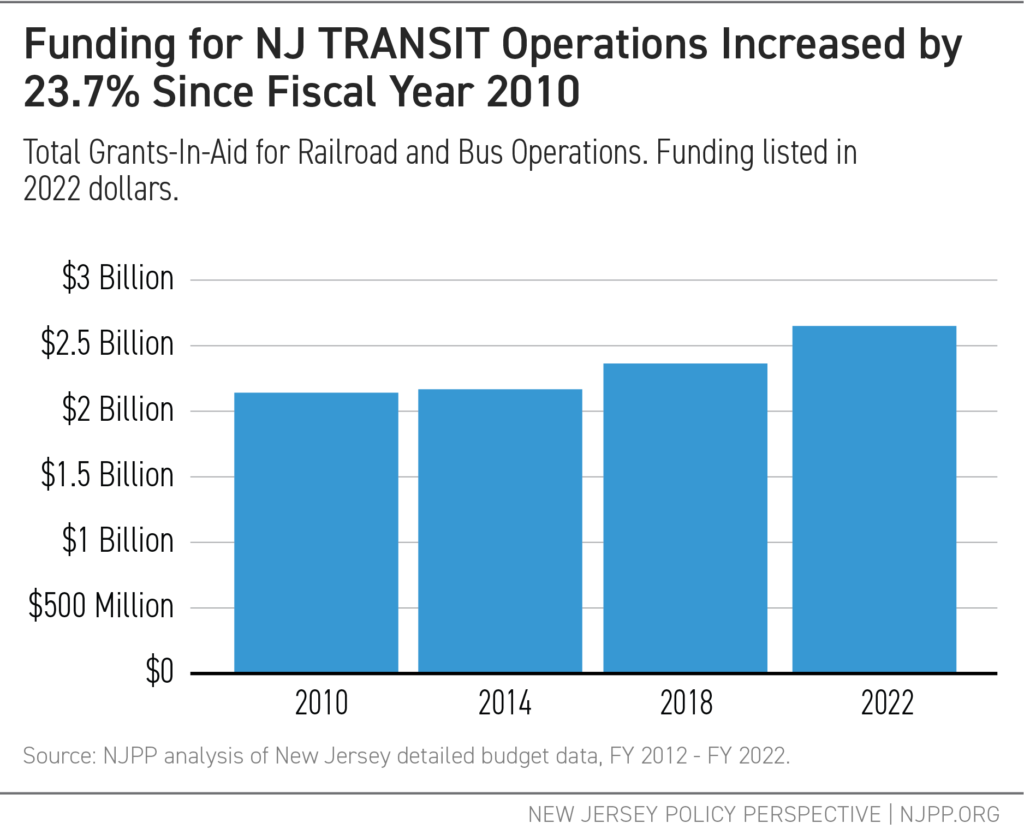

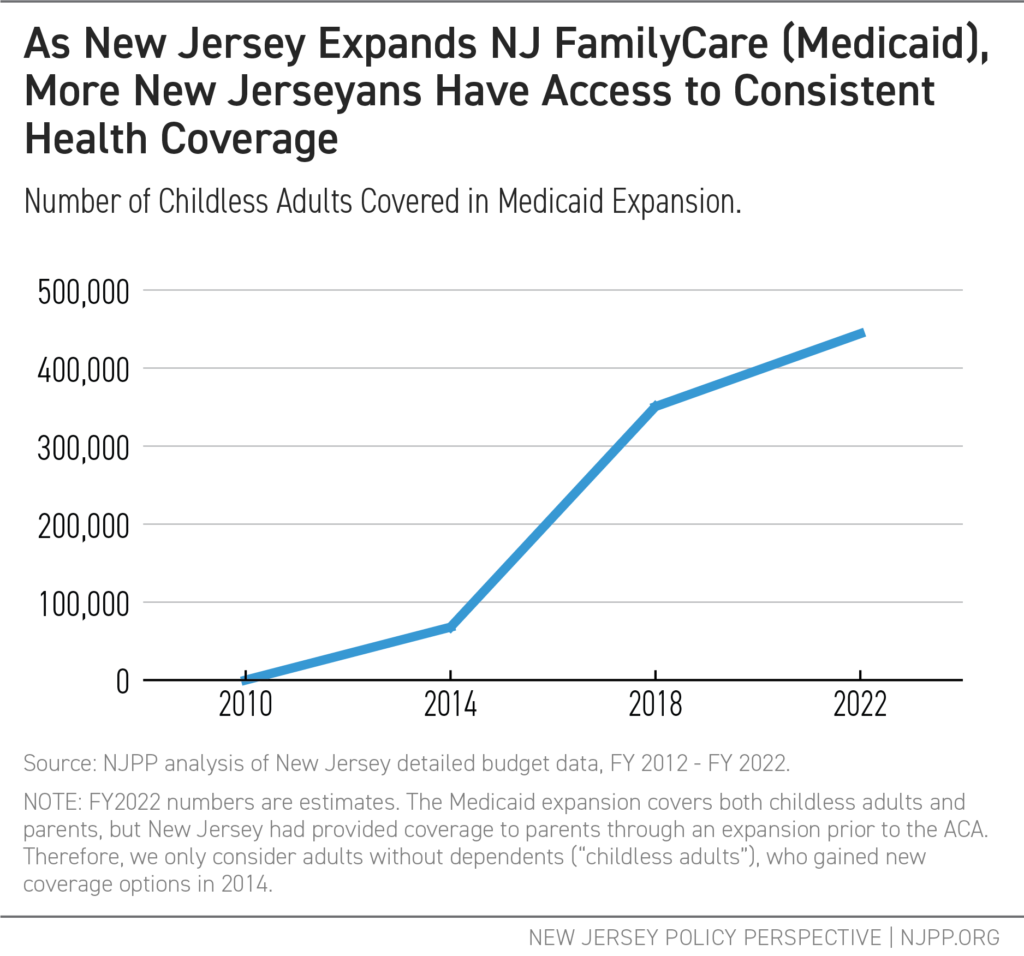

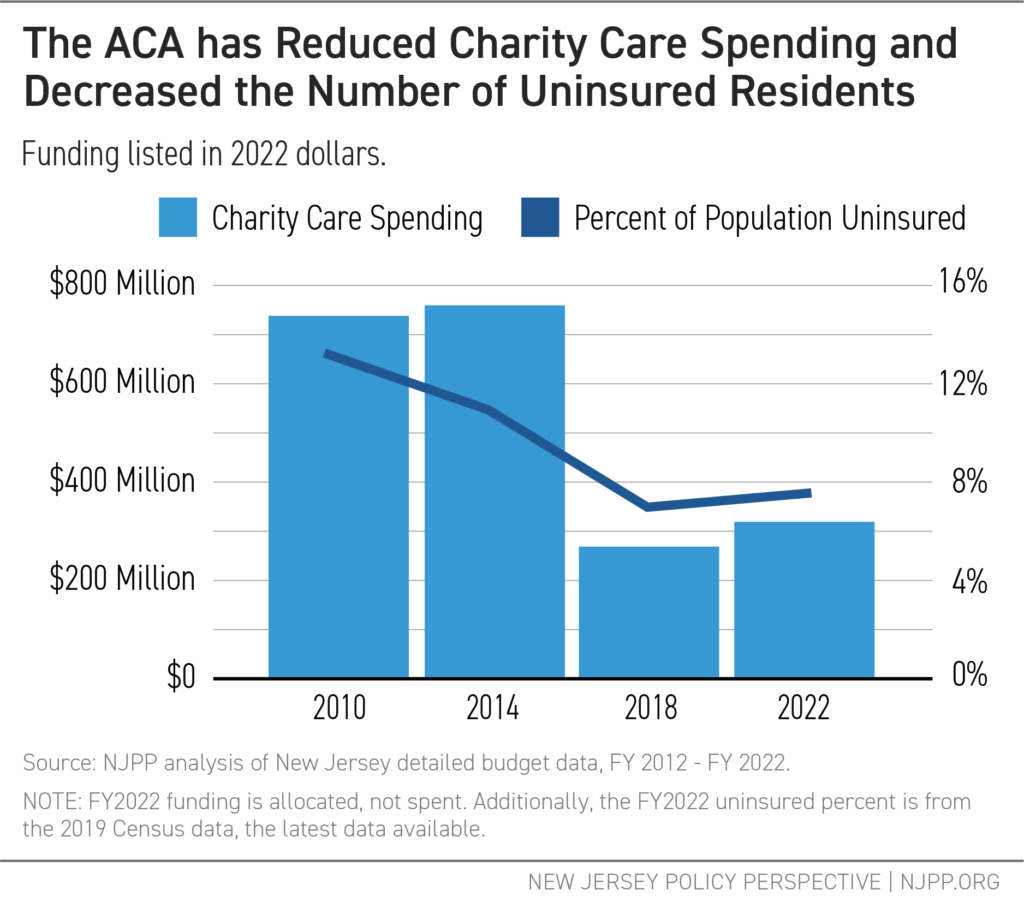

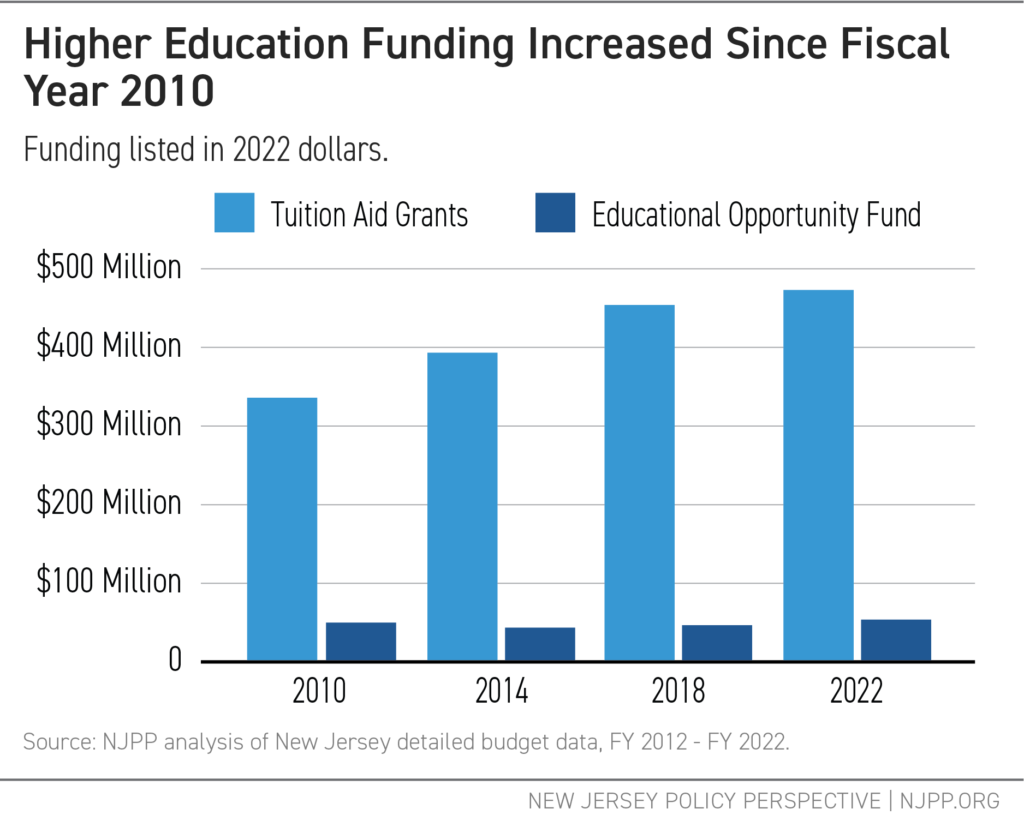

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

Phase Three - The Electric Vehicle Charger Incentive.

. 30 of the cost OR maximum 1000. ChargEVCs analysis finds that we will need 40 million in additional funding to keep the program open through the end of the current state fiscal year June 30 2022 and stay on track to hit our goals. You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV.

0 0 You Save 4366. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021. 2000 - 5000.

Charge Up New Jersey. The program may close sooner if its budget is depleted before the deadline. Murphy proposes 49B budget with no new taxes more school aid.

Revised FY22 Charge Up New Jersey Compliance Filing Program budget for Phase Two was 23M which was committed and expended by September 15 2021. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. President Bidens EV tax credit builds on top of the existing federal EV incentive.

The next fiscal year begins July 1 2022. New Jersey has a lot to offer to travelers from in and out of state and Asbury Park is one of the states premier tourist destinations. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

Even entry-level EVs cost more than 30000. Electric Vehicles Solar and Energy Storage. Local and Utility Incentives.

The reason is that once a car manufacturer sells its 200000th vehicle the credit is reduced being cut in half to 3750 is then halved again after a period and then finally phased out. The Charge Up New Jersey Program has been successful for the second year in a row. Jan 6 2022.

Audi 2021 e-tron 222. The credit is set to reduce to 22 in 2023 and will not be continued thereafter unless Congress approves an extension. New Jerseys EV law provides the BPU with budget flexibility in its establishment of the rebate program.

Rebates are key to getting more EVs on New Jersey roads because the cars remain substantially more expensive than gas-powered vehicles. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 3500 credit. The official name of this incentive is the Investment Tax Credit or ITC.

The exemption is NOT applicable to partial. That would nearly double the 2 billion-plus surplus that was budgeted as part of the spending plan. At first glance this credit may sound like a simple flat rate but that is.

With the states commitment to electric vehicles and the build-out of the necessary charging infrastructure coupled with commitments from the Biden administration New Jersey is well on the way to achieving Murphys EV goals according to Fiordaliso. The Charge Up New Jersey Program has been successful for the second year in a row. Several months later it seems that revisions to the credit are returning to lawmaker agendas.

The 26 federal solar tax credit is a nationwide benefit and you can combine it with New Jersey solar incentives to improve your ROI. Updated April 2022. Second year in operation.

However keep in mind. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. In June 2021 New Jerseys Clean Energy Program NJCEP allocated a total of 7 million for Fiscal Year 2022 dedicating 6 million for use by state.

PL2019 c362 granted the BPU the authorization to develop. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The deadline to order purchase or lease an eligible electric vehicle was Wednesday September 15 2021.

The New Jersey Treasurys website was recently updated with a complete list of all 2019 vehicles that qualify. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

Prior to Jan. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of. At least 30 million per year for 10 years.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Atlantic City Electric - NJ has a rebate program that covers residential EV chargers. Also the NJBPU announced the Electric Vehicle Tourism Program opened today March 21 2022 for the second round of applications.

Charge Up New Jersey promotes clean vehicle. The total additional amount budgeted for the revised FY22 Program is 20 million. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Standard and Charge Ahead Rebates can be combined for up to 7500 toward the purchase or lease of a new eligible vehicle. Plug-in Hybrid Electric Vehicles. 1000 is the maximum per installation.

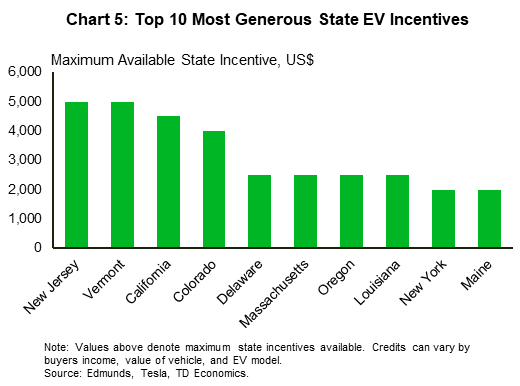

Receive an incentive of up to 5000 when you purchase or lease a new electric vehicle. Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year. 2500 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle. 1 day agoBudget Business.

The second round of applications will close on May 16 2022. The program is called ACE EVsmart Program The program is currently open with an expected end date of December 31st 2026. Yes the state of New Jersey has a tax credit for electric car drivers.

Under the fiscal year 2023 budget plan Murphy unveiled in early March New Jersey would end the next fiscal year with more than 4 billion socked away in surplus. If you dedicate the 14-50 charging cable to your home you should be able to claim the tax credit of the lesser of. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

The New Jersey Legislature exempts residents from paying state sales tax on the purchase or lease of a zero-emissions vehicle which includes BEVs but. The federal EV tax credit amount is affected by your tax liability. Electric Vehicle Incentive Program for eligibility and program updates.

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Southern California Edison Incentives

The Us Electric Vehicle Market Navigating The Road Ahead

Eligible Vehicles Charge Up New Jersey

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

-Alt-FI.jpg?t=1643677311&width=1080)

Report Evs At Price Parity With Ice Vehicles In 2022 Rto Insider

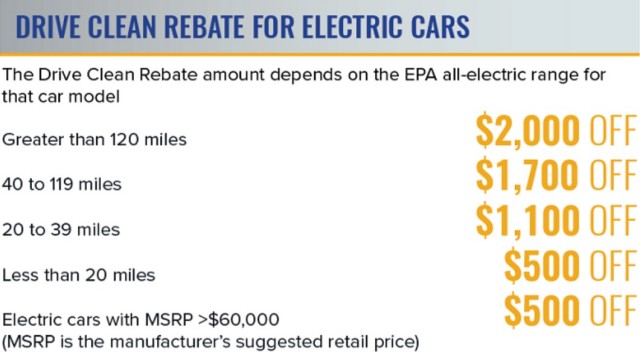

Ny 2 000 Electric Car Rebate Falls To 500 If It S Over 60k Sorry Tesla

Additional Incentives Charge Up New Jersey

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

Additional Incentives Charge Up New Jersey

Latest On Tesla Ev Tax Credit March 2022

Shining A Light On New Jersey S Fy 2022 Budget New Jersey Policy Perspective

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

The Ev Tax Credit Phaseout Necessary Or Not Georgetown Environmental Law Review Georgetown Law