santa clara county property tax credit card fee

Santa Clara County 1800. 1110 of Assessed Home Value.

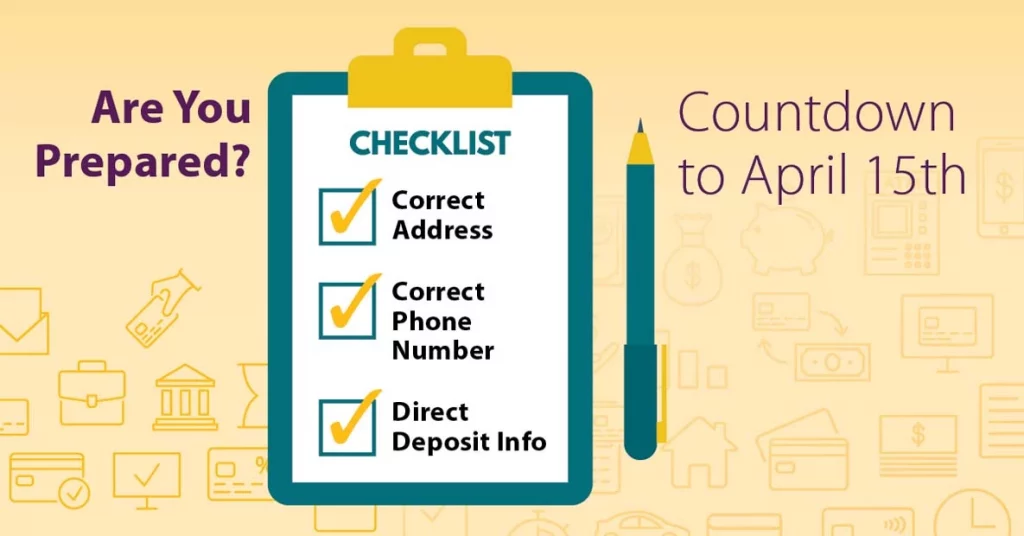

Are You Ready For Tax Season Santa Clara County Federal Credit Union

Enter Property Parcel Number APN.

. Santa clara county property tax credit card fee. Credit Cards accepted are. In Santa Clara County the average effective property tax rate is 073.

A non-refundable processing fee of 110 is required in Santa. Property taxes can be paid. On Monday April 11 2022 to pay their taxes.

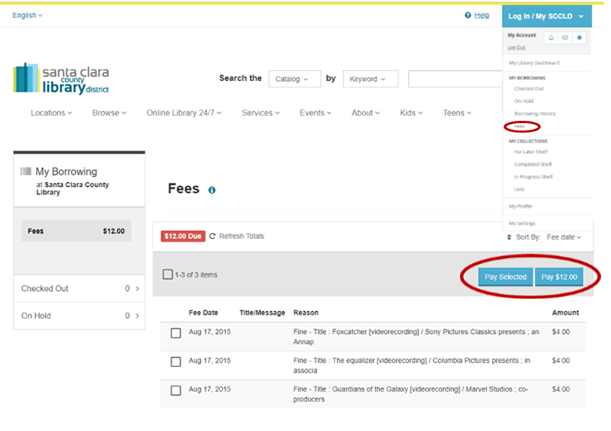

12345678 123-45-678 123-45-678-00 Submit. You may pay your property taxes online via MasterCard Visa Discover or American Express credit card. Property owners in Santa Clara County have until 5 pm.

The Santa Clara County Tax Collector. Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund. You can pay online using a creditdebit card or using an electronic check at.

900 AM to 400 PM Monday Friday excluding County Holidays. If You Use A Credit Card In Santa Clara County Can You Pay Property Tax. Visa Master Card American Express and Discover.

Pay by Phone. Confidential Marriage License 8300 Pay with cash check or creditdebit card 250 convenience fee for credit and debit cards Get Married. The county does provide a web portal to pay your tax bills.

Pay with Credit Card. Send us an Email. 0720 of Assessed Home Value.

The fee to use a credit card will vary based on your county but theyre almost always at least 2 and often more than 25 of the total tax. Property tax rates for Santa Clara County California are as follows. The fee amount is based upon a percentage of the transaction.

0740 of Assessed Home Value. Department of Tax and Collections. Sunday September 4 2022Edit.

77 - Dattathreya Temple 94 -. The fee amount is. Property Taxes Department Of Tax And Collections County Of Santa Clara.

Because of weekends and holidays please transfer funds 3-4 days prior to the bills due date in order to avoid any possible late fees from incurring on the accounts. We accept payments of cash checks and credit cards Subject to transaction fee see below. There is an internet payment fee.

If you elect to pay by credit card please be aware that these fees are added to your transaction. Valuation Based Fee Table for Building Permit Review. Failure to pay the balance by the due date will result in a 10 late fee.

Please note that additional credit card processing fees will be charged in addition to your.

Los Angeles Bankruptcy Lawyer For Credit Cards Ca Attorney

Santa Clara County Property Taxes Due Date Ke Andrews

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Lookup Alameda County S Official Website

Pay Your Property Taxes Unsecured Treasurer And Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Before Transferring A Credit Card Balance Do The Math The Mercury News

Humboldt County Supervisors Expand Ability To Pay Property Taxes In Monthly Installments Times Standard

Santa Clara County Transfer On Death Affidavit Form California Deeds Com

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Calculator Estimator For Real Estate And Homes

Scam Alert County Of Santa Clara California Facebook

Home Loans Santa Clara County Federal Credit Union

Standards And Services Division